Good safety precautions, on and off the road, are a must, but did you know that the ideal travel companion that keeps you financially on track is just a few clicks away? Flipkart and Bajaj Allianz General Insurance Company, India’s leading private general insurer, have come together to offer a digital motor insurance policy for your privately owned 2- wheelers and 4-wheelers.

Ensure peace of mind, especially in these times of lockdown, with award-winning features such as Motor On-the-Spot (OTS) and other add on benefits like 24/7 spot assistance, zero depreciation cover, cashless garages and transfer of No Claim Bonus.

Ready to turbocharge your ride? Here’s a snapshot of how your journey is going to be different with this Car or Two-Wheeler Insurance.

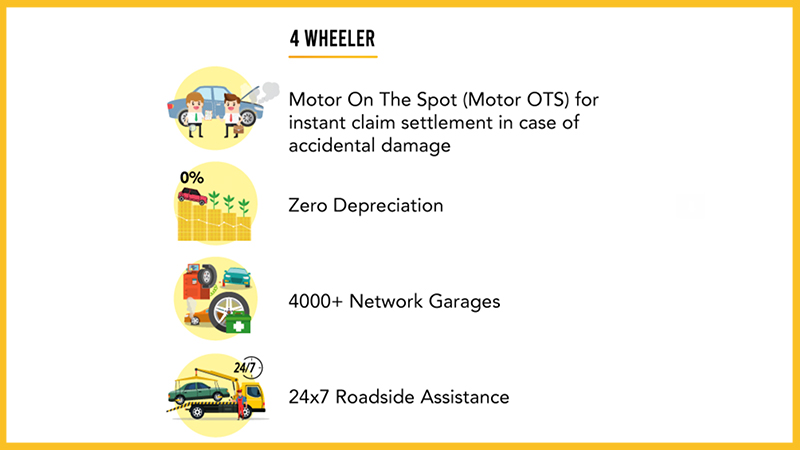

Four-wheeler insurance: It keeps you in the driver’s seat!

Protect your home on wheels with motor insurance plans that offer great value. With features like Motor OTS, 24/7 roadside assistance and cashless garages, you can keep your car in mint condition without hiccups. You get basic, standard, and comprehensive plans to choose from.

What you get

- 24/7 pan-India spot assistance: Get help with a flat tyre, to jumpstart a battery, to tow your vehicle and even get legal advice in case of an accident.

- 4,000+ cashless garages: Settle claims in a cashless manner, while availing high-quality services at your preferred garage.

- Easy online purchase/renewal: Shop for the motor insurance plan of your choice and renew it with equal ease.

- Motor On-the-Spot: Conduct a self-survey of your vehicle after an accident and get up to Rs.30,000 in 20 minutes!

- Zero depreciation: Reduce depreciation expenses and get a better claim compensation.

Packages Available

If you want to go the extra mile, here are 3 packages you can choose from:

- Drive Assure Economy: Includes Depreciation Shield, Engine Protector and 24×7 Spot Assistance

- Drive Assure Economy Plus: Includes Depreciation Shield, Engine Protector, 24×7 Spot Assistance, Keys and Locks Replacement and Personal Baggage

- Drive Assure Prime: Includes 24×7 Spot Assistance and Keys and Locks Replacement

Inclusions and exclusions

You get coverage for natural and man-made calamities such as fire, explosion, self-ignition, burglary, strikes, terrorist activities and malicious acts. You can also buy a Personal Accident Cover of Rs.15 lakh and a third-party liability cover. What you aren’t covered against is normal wear and tear, damages caused when driving under the influence of substances, when driving without a valid license and due to war.

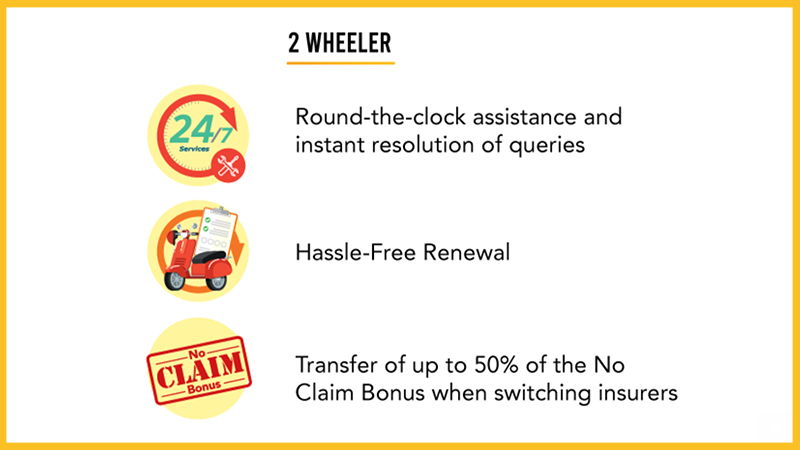

Two-wheeler insurance: A must-have in the toolkit

Purchase a Comprehensive Two Wheeler Insurance and stay financially protected against losses due to damage or theft and get coverage for third-party liability. You get 1-, 2- and 3-year plans with the 3-year motor insurance assuring you of an NCB benefit after claim as well as 0% hike in third-party premiums.

What you get

- Motor OTS: Conduct a self-survey after an accident to have your claim settled in minutes, digitally.

- Fuel assistance: Get help when running on empty through the 24/7 spot assistance service.

- Easy online purchase: Buy and renew your Two Wheeler Insurance with a few clicks, online.

- No Claim Bonus (NCB) transfer: Transfer up to 50% of your NCB from your previous insurer when you switch to Bajaj Allianz!

- Instant support: Get round-the-clock claim assistance, SMS claim status updates, and help via WhatsApp, chatbot or the toll-free number 1800 209 5858.

- Quick Claim settlement: Benefit from a swift turnaround time with a cashless claim settlement process and a wide network of cashless garages.

- Hassle-free renewal: Enjoy uninterrupted motor insurance by renewing your policy online. No inspection needed.

Packages Available

Want to give your bike another layer of protection? Here are 3 packages you can choose from.

- Drive Assure Basic: Includes Depreciation Shield

- Drive Assure Silver: Includes Depreciation Shield, Engine Protector and Consumable Expenses

- 24/7 Spot Assistance that focuses on providing spot assistance during emergencies

Inclusions and exclusions

You get coverage for losses and damages arising due to natural calamities such as fire, explosion, self-ignition, flood, hurricane and landslide and man-made calamities such as theft, riot, accident by external means and damages during transit. Additionally you can purchase a Personal Accident Cover of Rs.15 lakh and a third-party liability cover.

What you do not get coverage for is normal wear and tear of the bike, mechanical/ electrical breakdown, damages caused due to reckless riding, riding without license or under the influence of drugs/ alcohol, damages due to war, theft of accessories and wear and tear of consumables like tyres.

How to apply for a 2-wheeler and 4-wheeler motor insurance?

- You can add the right motor insurance to your gear without leaving your home! Simply:

- Ensure you have the latest update of the Flipkart App

- Click on the hamburger icon in the top-left corner

- Navigate to ‘Insurance’ and click

- Tap on ‘2 Wheeler’ or ‘4 Wheeler’, as per your needs

- Enter your name and hit ‘Get a quote’ to get started

If securing your ride takes nothing more than a few clicks, why wait any longer? Sign up for a motor insurance policy by Flipkart and Bajaj Allianz today!

Please note that the feature is available on the Flipkart m-site, Flipkart Android & iOS app.

Also read: Insurance on Flipkart: Get Industry’s first Life+COVID-19 Hospitalization Cover in a Single Product